For a large part of the year, but especially during the holidays, for many companies or wealthier individuals, it comes to the fore to support initiatives, goals, and organizations which are important to them, with donations and offerings. The charity sector has grown enormous. Many of which see only thats positive side, although it also provides opportunities for tax avoidance, while (under with the law) shortening the budget by significant sums. After all, in most countries, including Hungary, if we donate to a charity, we can describe it from different public charges. It has also been argued that by supporting the charity with various tax technology solutions, the State is giving up the ability to decide on the use of resources democratically (i.e. through the representatives we directly elect). (Klaudia Kitti Gál) Read more…

For a large part of the year, but especially during the holidays, for many companies or wealthier individuals, it comes to the fore to support initiatives, goals, and organizations which are important to them, with donations and offerings. The charity sector has grown enormous. Many of which see only thats positive side, although it also provides opportunities for tax avoidance, while (under with the law) shortening the budget by significant sums. After all, in most countries, including Hungary, if we donate to a charity, we can describe it from different public charges. It has also been argued that by supporting the charity with various tax technology solutions, the State is giving up the ability to decide on the use of resources democratically (i.e. through the representatives we directly elect). (Klaudia Kitti Gál) Read more…

For a large part of the year, but especially during the holidays, for many companies or wealthier individuals, it comes to the fore to support initiatives, goals, and organizations which are important to them, with donations and offerings. The charity sector has grown enormous. Many of which see only thats positive side, although it also provides opportunities for tax avoidance, while (under with the law) shortening the budget by significant sums. After all, in most countries, including Hungary, if we donate to a charity, we can describe it from different public charges. It has also been argued that by supporting the charity with various tax technology solutions, the State is giving up the ability to decide on the use of resources democratically (i.e. through the representatives we directly elect).

Introduction

A donation is a grant in cash or in-kind that the donor provides to a non-governmental organization (‘NGO’), an ecclesiastical legal person, and for a public interest obligation without any obligation to repay. These benefits are collected by organizations by their primary purpose and public benefit purpose. So purposefulness is important: for example, in the case of an ecclesiastical legal person, it is expected to serve the credit activity that is defined by law. In the case of non-profit organizations, it must serve the purpose of the activity specified in the memorandum and articles of association. The donor’s goal in transferring the money/assets is not just the intent to assist but often the underlying cause of tax evasion or publicity accompanying the donation as an excellent marketing opportunity.

1. Would they be so beneficial? It is possible to discover underlying content?

Per domestic law, we can only talk about a donation if the support is selfless, free of any kind of support, and the support cannot have the purpose and result of receiving support from the sponsor. Thus, the rules of the gift which are regulated by civil law shall apply to the donation. If the donation complies with this rule as well as the requirement to be bound by the purpose, the donor will receive certain benefits. These benefits also appear at the level of corporate tax (‘TAO’), small business tax (‘KIVA’) and value-added tax.

2. Tax credits

According to the Hungarian legislation – namely the Act LXXXI of 1996 on Corporate Tax and Dividend Tax (’TAO Act’) –, the pre-tax profit in the case of corporate tax can be reduced by the percentage of the donation specified by law.[1] Under this Act, this can be done within the framework of a donation contract, the beneficiary can be a non-profit non-governmental organization, association, the Hungarian Damage Fund, the National Cultural Fund, a compensation fund, a higher education institution, or a trust fund, and the transfer must be voluntary and unpaid.

Concerning the TAO, it became possible to support the very popular spectator-team sports after 2011: the European Commission authorized Hungary first in 2011 and then in 2017 to provide state aid to the sports sector by means of a tax rebate through the TAO Act. In the first round (2011), the list included football, handball, basketball, water polo, and hockey, and then further expanded with volleyball in 2017.

The basic aid in relation to the TAO is described by the TAO Act as follows: „up to the amount of the aid certificate issued, he may claim a tax credit from the tax for the tax year of the aid (benefit) and subsequent tax years, but for the tax year ending last in the sixth calendar year following the calendar year of the aid (benefit), that this aid does not increase its pre-tax profit when determining the tax base; the condition for recourse shall be that the taxpayer has no overdue public debt when the application for the issue of the refund certificate is submitted by the body entitled to receive the aid.”[2] Alongside this basic aid, further tax credits could also be available, the conditions of which are set out in a specific legal act.

In addition to that many NGOs have identified a high risk of corruption and lack of transparency in connection with the support system, several other concerns have been raised. According to the recently published data, 450 billion Hungarian Forints (‘HUF’) have been poured into visual sports in the last six years, 43 percent of which went to football. In the five sports, the top five teams since 2011 have been able to pocket a total of 53 billion HUF, of which 23,3 billion went to football. In six years, the Puskás Academy in Felcsút received the most ‘TAO-money’, 12.5 billion HUF, but more and more money has recently arrived in Mezőkövesd, where it received almost 779 million HUF last year, and Kisvárda in the second division received more than 580 million HUF in support. A previous report, from 2015, was made by Transparency International under the title “Corruption Risks in Hungarian Sports Financing”, shows that these figures are not low at this time either.

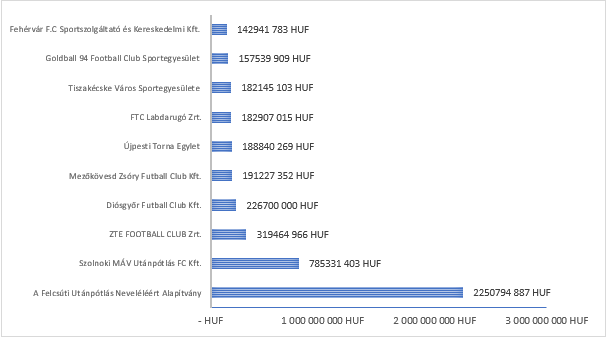

Figure 1. The total value of the support certificates issued by MLSZ for the 2014/2015 season

Source: Hungarian Central Statistical Office

Based on the grant certificates (the existence of which is a condition for the use of the basic grant), it is possible to trace the amount distributed in football. In fact, TAO aides can be seen as a specific form of state aid that companies provide, through a state incentive, by redirecting corporate tax. In other words, the support provided to sports organizations under the TAO Act is reduced by the State by reducing the corporate tax that can be collected, at the expense of the ‘tax expectation’. In contrast to traditional sponsorship, which companies payout of their after-tax profits, that is, from their after-tax income, sports grants under the TAO Act reduce companies ’pre-tax profits. As a factor reducing the tax base, sports aides under the TAO Act reduce the state’s tax revenue, i.e. it causes a loss of public money.

Prior to the introduction of the TAO aid scheme, the government sought the opinion of the European Commission, arguing that the introduction of a tax-subsidized aid scheme would in many cases (for example, support amateur sports) only mean a change in funding: economic actors instead of the central budget. provide funding. The Hungarian legislators consider this measure to be one of the least distortive types of state intervention, for example, compared to direct aides. However, the disproportionate distribution of aides shows that market mechanisms do not dominate the allocation of aides.

When the European Commission assessed the TAO aid scheme, it considered the resources used to be ‘public resources’, i.e. public funds. It stated that „state resources will clearly be involved in the program, as the Hungarian central budget will lose tax revenue as a result of the program.” It also stated that the use of the funds did not constitute state aid for the companies providing the aid but for the beneficiary sports organizations. However, the Commission did not oppose this, as it considered that „the safeguards proposed by Hungary guarantee the limitation of distortions of competition resulting from state intervention and that the overall effect of the measure is positive.” The European Commission did not attach any importance to the selection between sports organizations receiving funding.

3. The publicity of the donation?

The donation could also be offered to parties and non-governmental organizations, for a period of time the donor could only do so by taking his name. This, in fact, was what the Act LXXVI of 2017 on the Transparency of Organizations Receiving Foreign Funds was about, according to which party foundations are obliged to disclose the names of those who have contributed more than five hundred thousand Hungarian Forints to their operation. At the time of this legislation, e.g. the Helsinki Commission, which receives a lot of money from the Scandinavian countries under Hungarian law, if it received money from abroad, it could not happen anonymously. Moreover, according to this Act, an association and foundation that receives a monetary or other financial benefits of 7,2 million HUF directly or indirectly from abroad in a tax year are considered to be an organization supported from abroad. The grantor has a non-Hungarian registered office or place of residence or habitual residence outside Hungary.

The Court of Justice of the European Union has ruled that the aforementioned Act, which is often referred to as ‘Lex NGO’ by several news portals, contradicts the regulations of the European Union and of the Charter of Fundamental Rights as well. The Act in question requires NGOs to disclose if they receive funding from abroad and to indicate everywhere that they qualify as a ‘foreign-sponsored’ organization. According to the ruling, the regulation violates the principle of free movement of capital, the rights to the protection of personal data, and the principle of freedom of association, so the law „jeopardizes the role of civil society as an independent actor in democratic societies, undermining the right to freedom of association against them and restricting the privacy of donors.”

Thus, on May 18, 2021, Act XLIX of 2021 on the Transparency of the Non-Governmental Organizations Active in the Field of Public Policy was adopted, with which the aforementioned Act expired. This means that it is possible to donate anonymously again.

4. Is the tax credit considered to be the counter value of the donation?

Certainly not, but there is a motivating force for less tax to be paid to the state, as this appears as an item reducing the tax base.

It is a constitutional principle that taxation must be general, equal, and proportionate. Within proportionality, our Fundamental Law prescribes a contribution to public burdens under the principle of „bearing capacity and participation in the economy.” With the help of its redistributive function, the State can distribute the revenues of public finances to the appropriate strata, thus achieving basic services such as education and health care, which are mostly available to everyone on an individual basis. Donation reduces budget revenues by receiving a tax credit/exemption. Furthermore, the donor can decide according to his or her own set of values which strata, groups are in need, which decision is often not the same as the group that is really in need. While support from the budget is said to be anonymous by coming from the state, the donation creates a sub-superior relationship between the donor and the donor.

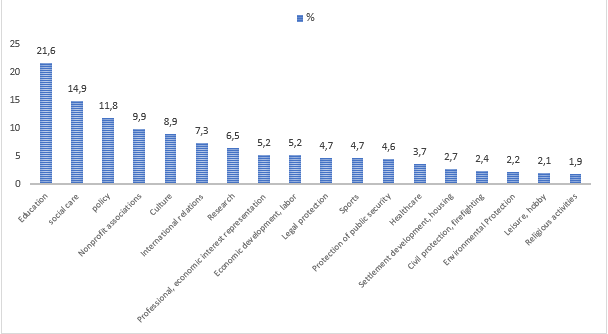

There are no recent statistics on the amounts provided by donors in Hungary; based on the published data of 2016, the Hungarian Central Statistical Office only provides insight into the donation characteristics of non-profit organizations. It is clear from the chart that education, culture, and social care are the highest numbers in 2016.

Figure 2. The average amount of grants provided by sponsors per organization by activity group

Source: Hungarian Central Statistical Office

From the average aides per organization, a clear conclusion could be drawn: education, social care, and politics are the most affected areas.

5. What is the impact on the fair distribution of public spending?

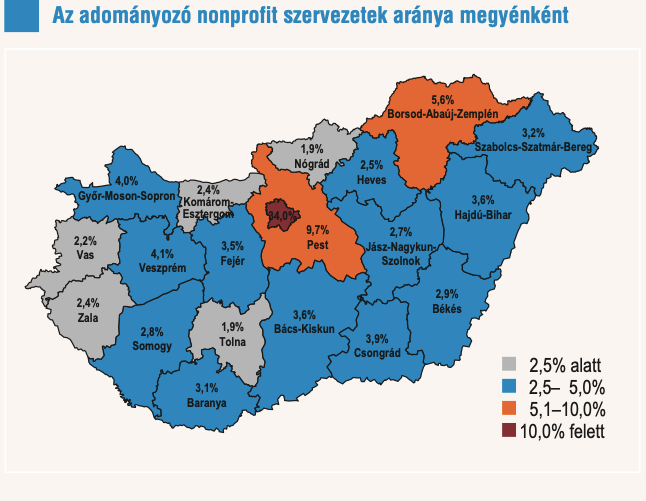

Figure 3. The distribution of donor non-profit organizations by county

Source: Hungarian Central Statistical Office

Tax payments are included in public revenues within public revenues. The State determines the planned expenditures and revenues in the budget law each year. Due to the tax-reducing effect of donations, unpaid taxes, which would otherwise be one of the main sources of revenue, cannot be redistributed by the State to places that should be visibly improved, such as health care. It is clear from the figure that there is a lot ahead of this area in terms of the distribution of donations: such as politics and sports.

The impact of donations on increasing social disparities is also reflected in our society. Wealthier parents support the child’s elite school and kindergarten, thus the school and kindergarten of poorer children show an even higher level of backwardness than before. A similar phenomenon can be observed between counties: in general, the donor supports a specific goal or institution in its own environment, so the financial resources remain fixed, so the lagging behind of smaller, poorer settlements becomes even more pronounced.

The total amount of grants awarded by donor organizations is around 140 billion HUF per year. 73% of this is provided by organizations based in the capital, and – taking into account that 67% of all grants are distributed locally – it can be stated that the donation activity is mainly concentrated in Budapest. The distribution by organizational type is as follows: 64% of the grants are provided by classic NGOs, 10,6% by business federations, and 26% by other non-profit organizations. Similar proportions apply to their revenue, expenditure and grants received. As a result, small towns receive less support than the developed capital, so the schools and hospitals there cannot develop to such an extent and compete with the larger cities. Due to the lack of development, young people settle in more developed cities and thus smaller villages and towns become depopulated over time.

Summary

In the light of what has been said, it is clear that there is a business opportunity in the donation and its nature-shaping, loss-making nature of the economy is clear. The disproportionate distribution of aids raises the question of the efficiency and sustainability of the current regulation of donation both at the institutional level and at the local level.

The study was made under the scope of the EFOP-3.6.1.-16-2016-00022 “Debrecen Venture Catapult Program”.

For a list of sources, click HERE.

Author: Gál Klaudia Kitti, law student, University of Debrecen, Faculty of Law

[1] Article 7. (1) TAO Act.

[2] Article 22/C. § (2) TAO Act.